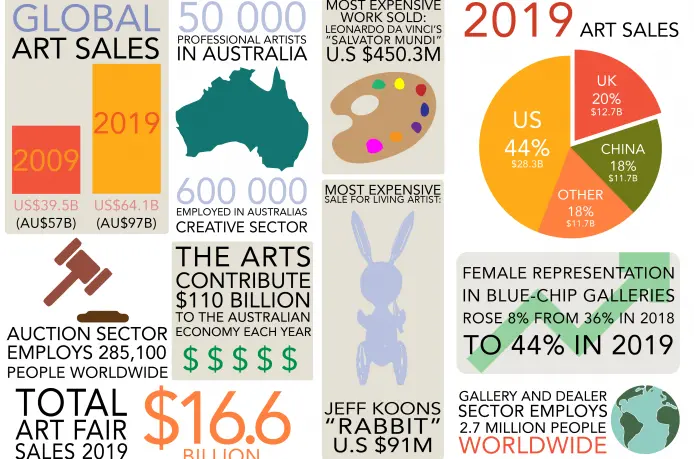

Global art market sales have grown rapidly from an estimate of US$39.5 billion (AU$57 billion) in 2009 to US$64.1 billion (AU$97 billion) in 2019 (McAndrew, 2020). The US, UK and China are the three major markets that account for 82% of the 2019 sales. The US leading with 44% (US$28.3 billion), of the total global sales, followed by the UK at 20% (US$12.7 billion), and China accounting for 18% (US$11.7 billion). However, all three major art markets were considerably down from their 2018 sales, the US down 5%, the UK 9% and China 10% (McAndrew 2020). Benjamin Sutton (2020) Artsy’s Lead Editor for Art Market and News, notes that the drop was potentially due to the UK’s Brexit negotiations and the US-China trade war. The United Nations (2019) has also acknowledged the trade tensions have exacerbated the “cyclical slowdown in the global economy.” The art market had viewed 2020 with optimism, yet Covid-19 has subdued growth again, and will probably result in much lower earnings and therefore a loss of jobs and opportunities.

Government restrictions on gatherings and travel have directly impacted the International Art Market. Locally, the iconic Sydney Carriage Works went into voluntary administration in early May due to an “irreparable loss of income” from the impact of Coronavirus. 920,000 people signed a letter – #CreateAustraliasFuture – directed to the prime minister and treasurer, asking them to act now to support Australia’s creative industry. In Australia, there are 50,000 professional artists and 600,000 people employed in the creative industry (Anatolitis, 2020). Over 90% of our artists, creators and businesses are not in receipt of public funding and are not able to benefit from these measures (NAVA, 2020). Our creative, cultural and entertainment industry contributes over AU$110 billion to Australia’s economy each year (NAVA, 2020). The creative industry was the first to stop trading, cancel events, close venues due to government restrictions, without industry support. Esther Anatolitis the Executive Director of the National Association of Visual Arts (2020) notes that the aviation industry which contributes AU$18 billion to Australia’s economy and is only a sixth the size of the creative industry was given an AU$750 million package.

On June 25 the Federal Government announced a $250 million “targeted package”, a range of new grant and loan programs to different parts of the arts sector.

International Art Fairs including Art Basel Hong Kong, Miaart Milan, Art Paris, Art Berlin, and Art Dubai have either cancelled or postponed due to Covid-19. Art fairs are where dealer’s make a large percentage of their annual sales. In 2019, fairs accounted for 30% of sales for dealers with a turnover of less than $500,000, this rose to 47% at the higher end for dealers with over $10 million in annual sales (McAndrew, 2020). Some dealers, galleries, and artists have found new creative approaches to selling and exhibiting art, perhaps for the better: the culture behind art fairs is disliked by many galleries and artists alike.

Visiting international art fairs has been described as an experience of “speed, confusion, tiredness, and peer-pressure” (Levy, 2016). Co-director of Frieze London Art Fair Matthew Slotover (2016) even acknowledges “I would never pretend that art fairs are the ideal place to look at art.” For collector and advisor Stefan Simchowitz (2016), art fairs are “punishing, but everyone is buying into it.” Despite the undesirable description, large galleries are estimated to be earning up to 47% of their annual income from fairs. International Art Fairs have grown in scale from 55 in 2000, to 300 in 2019. Sales have matched in growth from an estimate of US$12.7 billion in total art fair sales in 2015 to US$16.6 billion (AU$25 billion) in 2019 (McAndrew, 2020). This stands for approximately 26% of all art sales in 2019.

For collectors, the art fair is purely commercial with the aim to see everything under the same roof. For newer galleries and dealers, fairs are approached as opportunities for exposure. However, earning up to 47% of annual income is only achievable for blue-chip galleries that earn over US$10 million in annual sales. For galleries with a turnover of less than US$500,000, fair sales reached 30% of their total annual sales (McAndrew, 2020). While exposure is important for smaller galleries, the cost of participating in art fairs, from booth hiring to artwork transport and client dinners, is a major expense and can exceed profits made. It’s estimated the total expenditure for dealers on art fairs reached US$4.6 billion in 2019. Large galleries on the main floor at Art Basel have reported their total art fair expenses to be above US$400,000 (Freeman, 2016).

New York gallery James Fuentes states that fairs sell themselves to gallerists not based on making a profit but that they will go home with contacts (Freeman, 2016). For some dealers, this is true. A dealer at Art Basel Switzerland, who cut their usual US$40,000 cost on client dinners due to a lack of profit saw a contact from the fair return six months later and struck a US$5 million deal (Freeman, 2018). However, Fuentes noted that in his 10 years participating in one of the top international fairs, Frieze London, only two of those years saw a profit (Freeman, 2016). The art fair business model is risky and draws comparisons to a casino where the house always wins (Freeman, 2016).

Professor Simon Schama (2006) believes that art makes you look at the world afresh and shakes you out of routine. Covid-19 has caused the art world to reconsider the routine methods of exhibition and sales. New, digital, creative and community-based projects have emerged to look after the industry. Art Basel Hong Kong set up their booths online, New York gallery James Fuentes has set up an online exhibition viewing platform, art students from around the world are sharing their graduate works on Instagram in place of their graduation show (@socialdistancegallery). On a national scale, Hong Kong’s art community banded together to produce a non-commercial, community-wide online platform called ‘ART Power HK.’ It features online viewing rooms for galleries, recorded and live-streamed exhibition walkthroughs, interviews with Hong Kong-based artists and collectors, studio visits, and online talks (Rea, 2020). ART Power HK believes that “arts and culture is an essential foundation of a robust and creative society and economy.”

Covid-19 has hit Australia’s culture and creative industries hard – only 47% of arts and recreation services remain trading. A new, digital, creative shift in how we access, exhibit and sell artwork is required to maintain the contribution the arts makes to the Australian economy.